city of montgomery al sales tax application

Instructions for Uploading a File. City of Montgomery AL Inspections Department.

Alabama Severe Weather Sales Tax Holiday 2022 Starts Today What S On The List Al Com

The minimum combined 2022 sales tax rate for Montgomery Alabama is.

. Effective february 1 2021 the montgomery county wheel tax will increase to 7400. THIS FORM SHOULD BE RETURNED IN ITS ENTIRETY Please read definitions on back prior to completing. If zero tax is due.

Permitsmontgomeryalgov 25 Washington Ave. City of Montgomery AL Inspections Department. Montgomery county commission tax audit department p.

Taxpayer Bill of Rights. It will contain every up-to-date form application schedule and. Type of TaxTax Area A Gross Taxable Amount B Total Deductions C Net Taxable A-B D Tax Rate E Gross Tax Due C x D Sales Tax a.

This tax is in lieu of the 5 general sales tax. 2018 Rental Tax Return- City Police Jurisdiction. The Alabama sales tax rate is currently.

Box 5070 Montgomery AL 36101. 2018 pj sales tax updated oct. Area General Rate Manufacturing Machinery Rate.

City of Montgomery This form combines sales and sellersconsumers use tax reporting. Box 327740 Montgomery AL 36132-7740 Taxpayer Service Centers. The Tax Audit Department is located in the Montgomery County Courthouse Annex III Building located at 101 S.

We recommend that you obtain a Business License Compliance Package BLCP. This is the total of state county and city sales tax rates. 2019 Sales Tax updated Oct.

The sales tax discount consists of 5 on the first 100 of tax due and 2 of all tax over 100 not to exceed 40000. Morgan county al sales tax rate. Alexander city auburn and montgomery al chevrolet shoppers can simply fill out our secure online credit application to get the ball rolling.

Find due date information for monthly quarterly and annual filings of taxes administered by Sales Use. Type of TaxTax Area A Gross Taxable Amount B Total Deductions C Net Taxable A-B D Tax Rate E Gross Tax Due C x D Sales Tax a. Montgomery AL Application For SalesUse Tax Registration.

The mailing address is P. Type of TaxTax Area A Gross Taxable Amount PJ B Total Deductions C Net Taxable A-B D Tax Rate E Gross Tax Due C x D Sales Tax a. What is the sales tax rate in Montgomery Alabama.

Box 4779 Montgomery AL 36103-4779 Tax Period and complete lower portion of back side TOTAL AMOUNT ENCLOSED Make check payable to. The County sales tax rate is. Box 4779 Montgomery AL 36103.

Montgomery county clerk 350 pageant lane suite 502 clarksville tn 37040 map directions phone. For business entities new to Alabama the tax accrues as of the date of organization qualification or beginning to do business and is due 30 days. 3rd Floor Montgomery AL 36104 Phone.

334-625-2994 Hours 730 am. The offices are located on the 2nd floor. Depending on the type of business where youre doing business and other specific regulations that may apply there may be multiple government agencies that you must contact in order to get a Montgomery Alabama Sales Tax Permit.

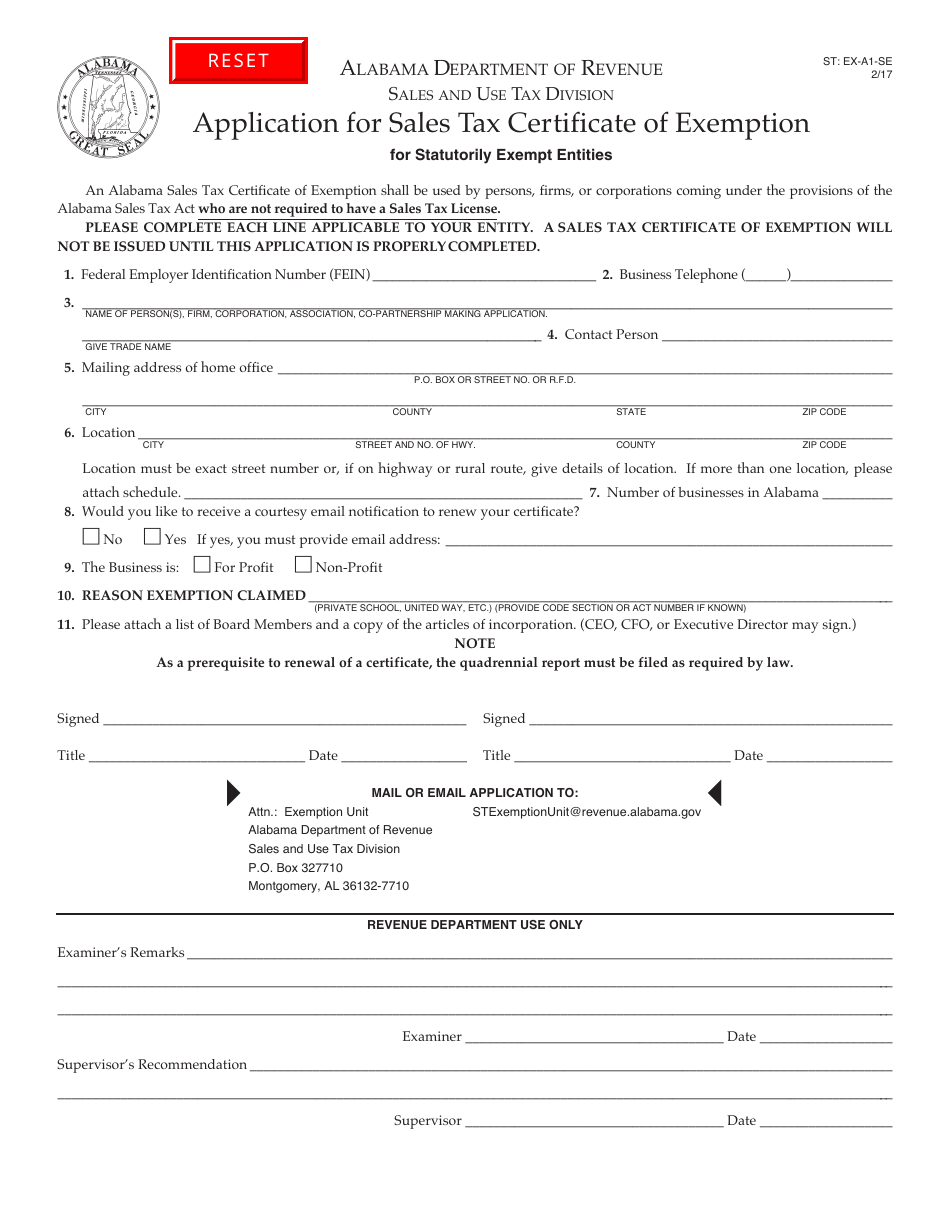

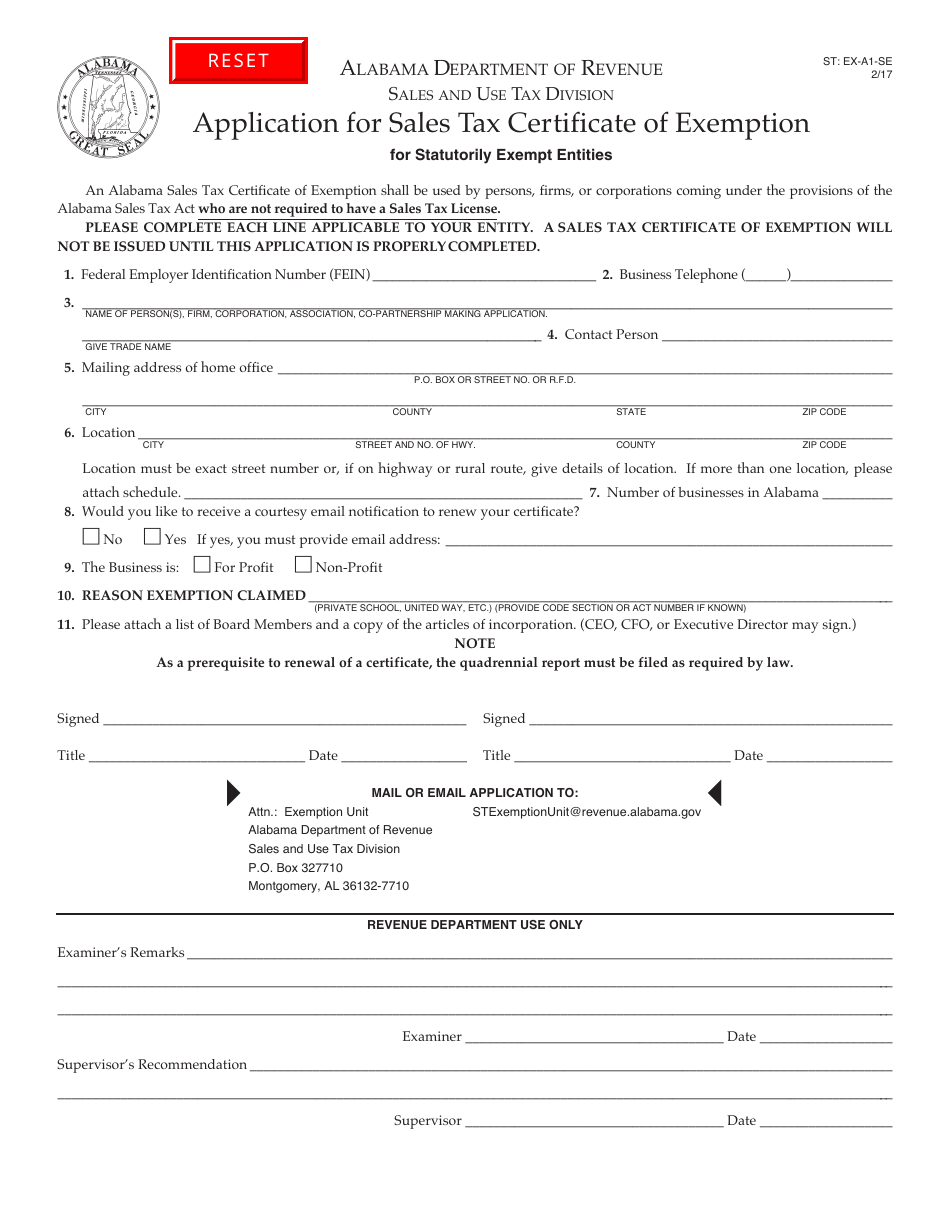

Sales and Use Tax. City of montgomeryrevenue division po. Min of 50 or 10 of tax due any correspondence should be mailed to.

A Montgomery Alabama Sales Tax Permit can only be obtained through an authorized government agency. In addition to the rental tax rates currently displayed on our website for the categories of automotive general and linen the city of montgomery levies a tax rate that applies to the short term rental of. Prepare and file your sales tax with ease with a solution built just for you.

25 0333 State of Alabama. Childersburg tax rates for rentals made and lodgings provided within the corporate limits and police jurisdiction of the city. Ad Have you expanded beyond marketplace selling.

Online filing available for sales tax reporting. This is the total of state county and city sales tax rates. City of Montgomery License and Revenue Division CO Department RBT3 PO Box 830525 Birmingham AL 35283-0525.

Avalara can help your business. If paying via EFT the EFT payment information must be transmitted. Montgomery AL Application For SalesUse Tax Registration.

New Business License and Tax Remittance Mailing Address. Effective JUNE 1 2022 please begin remitting sales business tax and business license returns and payments to the remittance address below. Access directory of city county and state tax rates for Sales Use Tax.

Montgomery AL Application For SalesUse Tax Registration. The Montgomery sales tax rate is. To report a criminal tax violation please call 251 344.

If you need information for tax rates or returns prior to 712003 please contact our office. In completing the CityCounty Return to filepay Montgomery County. THIS FORM SHOULD BE RETRURNED IN ITS ENTIRETY Please read definitions on back prior to completing.

City of Montgomery This form combines sales and sellersconsumers use tax reporting. The Montgomery sales tax rate is. THIS FORM SHOULD BE RETURNED IN ITS ENTIRETY Please read definitions on back prior to completing.

City of Montgomery This form combines sales and sellersconsumers use tax reporting. If paying via EFT the EFT payment information must be transmitted by 400 pm. Motor FuelGasolineOther Fuel Tax Form.

City of Montgomery This form combines sales and sellersconsumers use tax reporting. If you are currently setup to Electronically File State of Alabama SalesUse Taxes online step by step instructions for adding Montgomery County to your online filing through the MAT system are also available at revenuealabamagovsales-useone-spot. SALES TAX ALCOH.

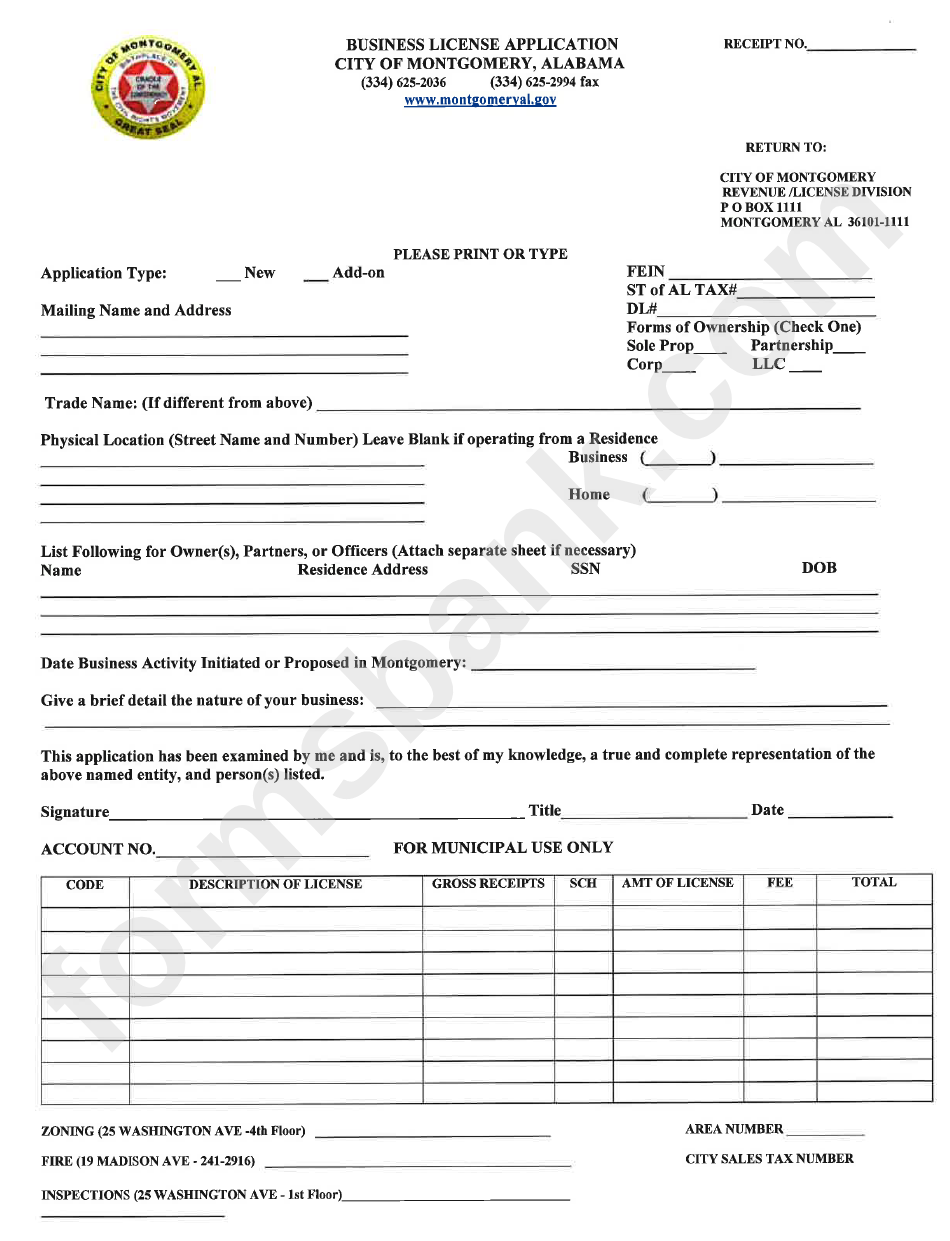

Did South Dakota v. Business Tax License Application. SalesSellers UseConsumers Use Tax Form.

Central Standard Time on or before the due date to be considered timely paid. City of Montgomery Lodging Tax updated Dec. Sales and Use Tax.

Businesses that are located in the city of Montgomery or conduct business inside the city limits or police jurisdiction should contact the City Business License Department for city licensing information. SalesSellers UseConsumers Use Tax Form. Montgomery al sales tax rate the current total local sales tax rate in montgomery al is 10000.

In all likelihood the Application For SalesUse Tax Registration is not the only document you should review as you seek business license compliance in Montgomery AL. Columbiana additional 4 sales tax on the retail sale of any liquor or alcoholic beverages excepting beer sold for on or off premises consumption. Free viewers are required for some of the attached documents.

Montgomery al sales tax rate.

Gis Mapping Tool City Of Montgomery Al

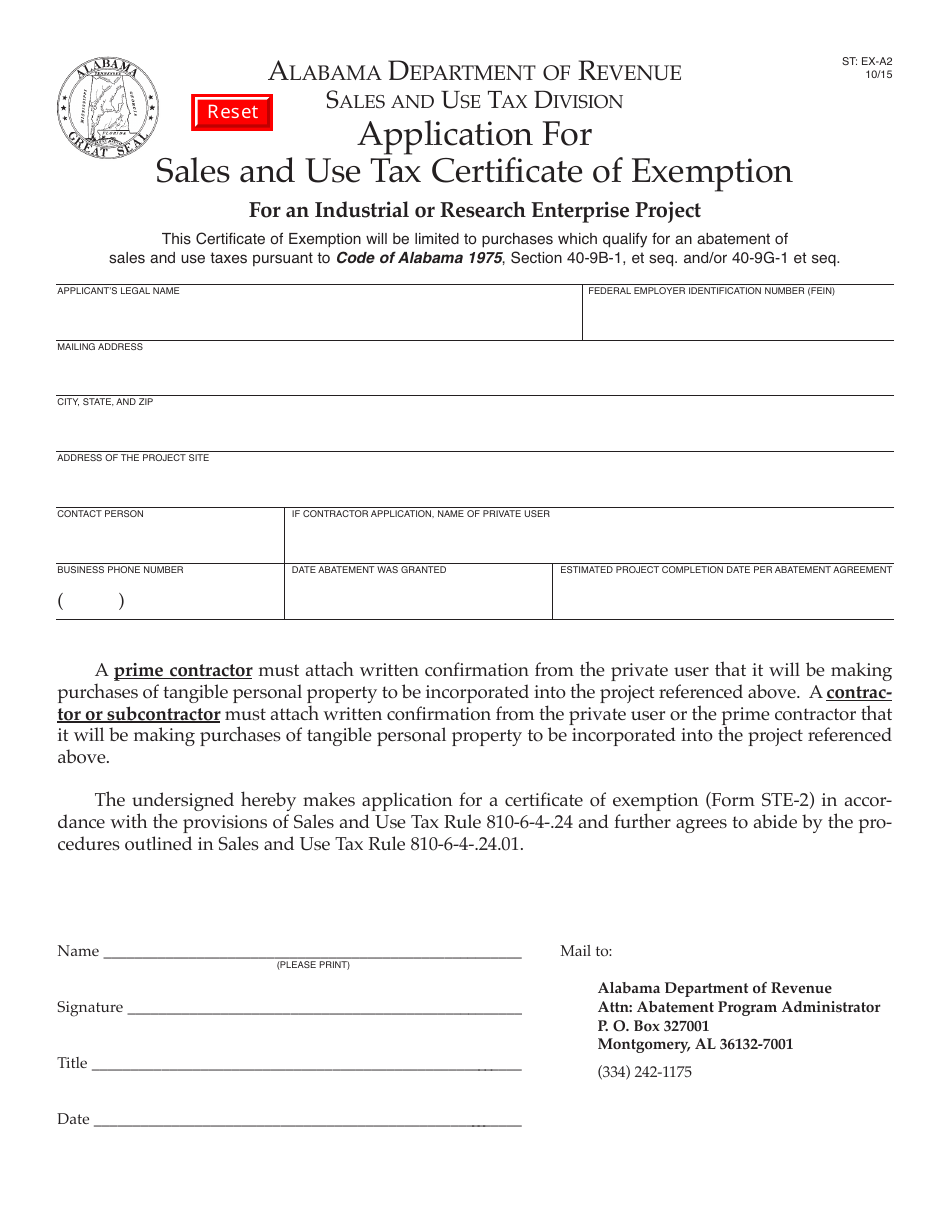

Form St Ex A2 Download Fillable Pdf Or Fill Online Application For Sales And Use Tax Certificate Of Exemption For An Industrial Or Research Enterprise Project Alabama Templateroller

Other Alabama Taxpayer Forms Avenu Insights Analytics Taxpayer

Alabama Sales Tax Guide For Businesses

Sales Tax Audit Montgomery County Al

Emergency Rental Assistance Montgomery County Eramco Montgomery County Al

Filing State Taxes Alabama Begins Processing Returns Today What To Know Al Com

/cloudfront-us-east-1.images.arcpublishing.com/gray/VOGN2AILK5A2FIXKMDRE2ZUVNU.jpg)

2021 Tax Filing Tips From Aldor

Maintenance Districts Montgomery County Al

Form St Ex A1 Se Download Fillable Pdf Or Fill Online Application For Sales Tax Certificate Of Exemption For Statutorily Exempt Entities Alabama Templateroller

Appraisal Montgomery County Al

Alabama Color County Maps Cities Towns

Montgomery Alabama Al Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders